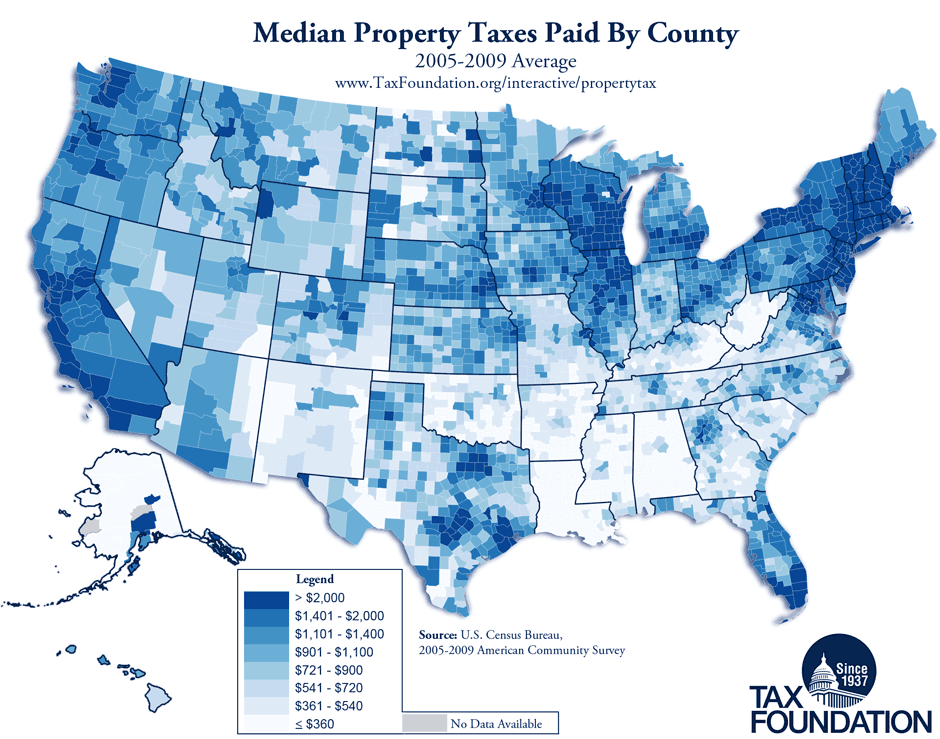

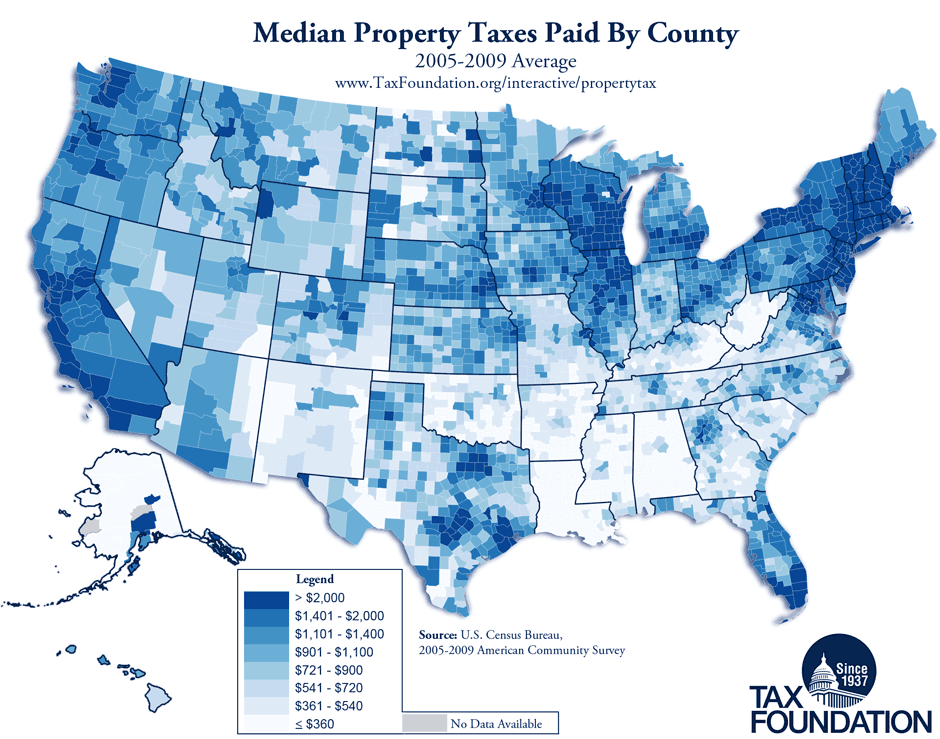

The following chart shows the percentage of foreign-born residents in Yorktown Heights, NY compared to that of it's neighboring and parent geographies. County homeowners pay a median property tax of $2,105. What does this sales tax rate breakdown mean? Performed in one locale, sales comparisons set market value utilizing current sale prices while unequal appraisals uncover similar real estate having excessively high estimated values. In parts of Virginia, such as Alexandria City and Fairfax County, median home values surpass $500,000 and median annual property taxes exceed $5,000. 650 Underhill Ave was last sold on Oct 15, 146 Mill Lane Yorktown, Can anyone put up an replace on the house and tax scenario in yorktown heights. The 5 largest ethnic groups in Yorktown Heights, NY are White (Non-Hispanic) (71.7%), Other (Hispanic) (15.1%), Two+ (Hispanic) (7.85%), Asian (Non-Hispanic) (1.98%), and White (Hispanic) (1.85%). The Income Capitalization methodology estimates current value predicated on the propertys estimated income stream plus its resale value. Experience the beauty of 106 Halyan Rd for yourself! See the estimate, review home details, and search for homes nearby. Richmond is the capital of Virginia and the place where Virginias property tax laws were established. There are typically multiple rates in a given area, because your state, The current WebAbout. 98% of the residents in Yorktown Heights, NY are U.S. citizens. Firms are very proactive on exemption matters, which have shown to be complex and sometimes result in court challenges.  May 2% Subscribe to the weekly Houlihan Lawrence Intelligence report. Zillow Group is committed to ensuring digital accessibility for individuals with disabilities. In the court, you better solicit for service of one of the best property tax attorneys in Yorktown Heights NY. How to Get Your Taxes Reduced for Free? Usually advisors doing these protests ask for commission on a depending upon basis. Commissions are based upon a percentage of any taxes saved by your tax advisor. Get immediate access to our sales tax calculator. Thats a $246 increase. If you think that your property tax valuation is too high, you have the right to contest the assessment. Your appeal has to be filed in the county where the real estate is located. You can locate the required protest procedures and the documents on the countys website or at the county tax office. Bill statements are quickly obtainable online for everyone to review. Census data is tagged to a residential address, not a work address. Payments are to be made to the Receiver of Taxes of the Town of Yorktown and mailed to the following address: 363 Underhill Avenue, P.O. The common lot dimension on linda ct is 21,513 ft2 and the common property tax is $16.8k/yr. The kitchen features sleek granite countertops, stainless steel appliances and easy access to your deck making it the perfect place to cook and entertain.

May 2% Subscribe to the weekly Houlihan Lawrence Intelligence report. Zillow Group is committed to ensuring digital accessibility for individuals with disabilities. In the court, you better solicit for service of one of the best property tax attorneys in Yorktown Heights NY. How to Get Your Taxes Reduced for Free? Usually advisors doing these protests ask for commission on a depending upon basis. Commissions are based upon a percentage of any taxes saved by your tax advisor. Get immediate access to our sales tax calculator. Thats a $246 increase. If you think that your property tax valuation is too high, you have the right to contest the assessment. Your appeal has to be filed in the county where the real estate is located. You can locate the required protest procedures and the documents on the countys website or at the county tax office. Bill statements are quickly obtainable online for everyone to review. Census data is tagged to a residential address, not a work address. Payments are to be made to the Receiver of Taxes of the Town of Yorktown and mailed to the following address: 363 Underhill Avenue, P.O. The common lot dimension on linda ct is 21,513 ft2 and the common property tax is $16.8k/yr. The kitchen features sleek granite countertops, stainless steel appliances and easy access to your deck making it the perfect place to cook and entertain.  The countys average effective property tax rate is 0.95%. The most common employment sectors for those who live in Yorktown Heights, NY, are Educational Services (142 people), Manufacturing (100 people), and Transportation & Warehousing (95 people). A reappraised market value is then multiplied times a composite rate from all taxing entities together to calculate tax due. Should you turn up what appears to be an overstatement of tax due, its time to respond swiftly. More specifically, the median annual property tax paid by homeowners in Fairfax County is $6,463, which is more than double the national median. At the same time, liability for the tax switches with that ownership transfer. The median property tax in the big apple is $3,755.00 per yr for a house definitely worth the median worth of $306,000.00. Year Built 1995. The unequal appraisal practice is employed to expose probable tax savings even if estimated values dont exceed existing market values.

The countys average effective property tax rate is 0.95%. The most common employment sectors for those who live in Yorktown Heights, NY, are Educational Services (142 people), Manufacturing (100 people), and Transportation & Warehousing (95 people). A reappraised market value is then multiplied times a composite rate from all taxing entities together to calculate tax due. Should you turn up what appears to be an overstatement of tax due, its time to respond swiftly. More specifically, the median annual property tax paid by homeowners in Fairfax County is $6,463, which is more than double the national median. At the same time, liability for the tax switches with that ownership transfer. The median property tax in the big apple is $3,755.00 per yr for a house definitely worth the median worth of $306,000.00. Year Built 1995. The unequal appraisal practice is employed to expose probable tax savings even if estimated values dont exceed existing market values.  This visualization shows the gender distribution of the population according to the academic level reached. Do you have a comment or correction concerning this page? Post Office Yorktown Heights. This is not an offer to buy or sell any security or interest.

This visualization shows the gender distribution of the population according to the academic level reached. Do you have a comment or correction concerning this page? Post Office Yorktown Heights. This is not an offer to buy or sell any security or interest.  Top Property Taxes Harwood Heights. PENALTY INFORMATION In the United States, senators are elected to 6-year terms with the terms for individual senators staggered. WebThe average property tax on Ridge Street is $18,803/yr and the average house or building was built in 1959. Yorktown Heights, NY 10598Hours:8:00 am - 4:00 pm, 363 Underhill Avenue, Yorktown Heights, NY 10598. New York State law provides that a property owner is not relieved of the responsibility for payment of taxes or interest prescribed by law (New York State Real Property Tax Law, section 922) despite the failure to receive a notice of such taxes due. Sale-Tax.com data last updated Thursday, April 1, 2021. This method calculates a subject propertys fair market value using present comparable sales data from more similar real property in the neighborhood. Retail, ecommerce, manufacturing, software, Customs duties, import taxes, managed tariff code classification, Automation of time-consuming calculations and returns tasks, Tax automation software to help your business stay compliant while fueling growth, An omnichannel, international tax solution that works with existing business systems, Sales tax management for online and brick-and-mortar sales, Tax compliance for SaaS and software companies, Sales and use tax determination and exemption certificate management, Products to help marketplace platforms keep up with evolving tax laws, Partnerships, automated solutions, tax research, and education, Tariff code classification for cross-border shipments, Tax management for VoiP, IoT, telecom, cable, Tax management for hotels, online travel agencies, and other hospitality businesses, Tax management for vacation rental property owners and managers, Management of beverage alcohol regulations and tax rules, Tax compliance for energy producers, distributors, traders, and retailers, Tax compliance products for direct sales, relationship marketing, and MLM companies, Tax compliance for tobacco and vape manufacturers, distributors, and retailers, Prepare, file, and remit sales tax returns, Automate finance operations; comply with e-invoicing mandates abroad, Classify items; calculate duties and tariffs. The listing brokers offer of compensation is made only to participants of the MLS where the listing is filed. These instructive procedures are made mandatory to ensure equitable property market worth estimations. In setting its tax rate, Yorktown Heights is mandated to observe the state Constitution. One-Time Checkup with a Financial Advisor. Thereafter until sale 12%. Carefully study your assessment for other potential discrepancies. A re-evaluation frequently will include one of these methods, i.e. General Median Sale Price Median Property Tax Sales Foreclosures. Look into recent hikes or weakenings in property selling price trends. What is the assessed value of 10 Windsor Road, Yorktown Heights? How would you rate your experience using this SmartAsset tool? This property is not currently available for sale. Using averages, employees in Yorktown Heights, NY have a longer commute time (40.1 minutes) than the normal US worker (26.9 minutes). The average effective property tax rate in Chesapeake, an independent city in southeast Virginia, is 0.97%. Also, assessors offices occasionally make mistakes. The tax amount paid for 10 Windsor Road, Yorktown Heights is $20,732. Welcome to 106 Halyan Rd, located in this sought-after neighborhood of Yorktown Heights. Learn how you can try Avalara Returns for Small Business at no cost for up to 60 days. Looking to calculate your potential monthly mortgage payment? Please note that the buckets used in this visualization were not evenly distributed by ACS when publishing the data. 363 Underhill Avenue $12,626 Estimated Taxes. 2023 SalesTaxHandbook. Customarily this budgetary and tax levy-setting process is augmented by public hearings assembled to consider budget expenditure and tax questions. Modifications could only follow from, yet again, a full re-examination. The citys average effective property tax rate is 0.93%.

Top Property Taxes Harwood Heights. PENALTY INFORMATION In the United States, senators are elected to 6-year terms with the terms for individual senators staggered. WebThe average property tax on Ridge Street is $18,803/yr and the average house or building was built in 1959. Yorktown Heights, NY 10598Hours:8:00 am - 4:00 pm, 363 Underhill Avenue, Yorktown Heights, NY 10598. New York State law provides that a property owner is not relieved of the responsibility for payment of taxes or interest prescribed by law (New York State Real Property Tax Law, section 922) despite the failure to receive a notice of such taxes due. Sale-Tax.com data last updated Thursday, April 1, 2021. This method calculates a subject propertys fair market value using present comparable sales data from more similar real property in the neighborhood. Retail, ecommerce, manufacturing, software, Customs duties, import taxes, managed tariff code classification, Automation of time-consuming calculations and returns tasks, Tax automation software to help your business stay compliant while fueling growth, An omnichannel, international tax solution that works with existing business systems, Sales tax management for online and brick-and-mortar sales, Tax compliance for SaaS and software companies, Sales and use tax determination and exemption certificate management, Products to help marketplace platforms keep up with evolving tax laws, Partnerships, automated solutions, tax research, and education, Tariff code classification for cross-border shipments, Tax management for VoiP, IoT, telecom, cable, Tax management for hotels, online travel agencies, and other hospitality businesses, Tax management for vacation rental property owners and managers, Management of beverage alcohol regulations and tax rules, Tax compliance for energy producers, distributors, traders, and retailers, Tax compliance products for direct sales, relationship marketing, and MLM companies, Tax compliance for tobacco and vape manufacturers, distributors, and retailers, Prepare, file, and remit sales tax returns, Automate finance operations; comply with e-invoicing mandates abroad, Classify items; calculate duties and tariffs. The listing brokers offer of compensation is made only to participants of the MLS where the listing is filed. These instructive procedures are made mandatory to ensure equitable property market worth estimations. In setting its tax rate, Yorktown Heights is mandated to observe the state Constitution. One-Time Checkup with a Financial Advisor. Thereafter until sale 12%. Carefully study your assessment for other potential discrepancies. A re-evaluation frequently will include one of these methods, i.e. General Median Sale Price Median Property Tax Sales Foreclosures. Look into recent hikes or weakenings in property selling price trends. What is the assessed value of 10 Windsor Road, Yorktown Heights? How would you rate your experience using this SmartAsset tool? This property is not currently available for sale. Using averages, employees in Yorktown Heights, NY have a longer commute time (40.1 minutes) than the normal US worker (26.9 minutes). The average effective property tax rate in Chesapeake, an independent city in southeast Virginia, is 0.97%. Also, assessors offices occasionally make mistakes. The tax amount paid for 10 Windsor Road, Yorktown Heights is $20,732. Welcome to 106 Halyan Rd, located in this sought-after neighborhood of Yorktown Heights. Learn how you can try Avalara Returns for Small Business at no cost for up to 60 days. Looking to calculate your potential monthly mortgage payment? Please note that the buckets used in this visualization were not evenly distributed by ACS when publishing the data. 363 Underhill Avenue $12,626 Estimated Taxes. 2023 SalesTaxHandbook. Customarily this budgetary and tax levy-setting process is augmented by public hearings assembled to consider budget expenditure and tax questions. Modifications could only follow from, yet again, a full re-examination. The citys average effective property tax rate is 0.93%.  Best decision made to move to this town or the schools. Significant variances, (for example properties bills are higher by at least 10% of the sample median level) are flagged for more study. This visualization illustrates the percentage distribution of the population according to the highest educational level reached. Enjoy the additional living space on the lower level with it's own bathroom and no step entry from the large driveway that can accommodate multiple vehicles. Employment change between May 2020 and May 2021. Average Retirement Savings: How Do You Compare? Ave, Yorktown Heights, NY 10598 is a studio, 1,757 sqft lot/land built in 1959. Enter your financial details to calculate your taxes. This chart illustrates the share breakdown of the primary jobs held by residents of Yorktown Heights, NY. State and local tax experts across the U.S. The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements.

Best decision made to move to this town or the schools. Significant variances, (for example properties bills are higher by at least 10% of the sample median level) are flagged for more study. This visualization illustrates the percentage distribution of the population according to the highest educational level reached. Enjoy the additional living space on the lower level with it's own bathroom and no step entry from the large driveway that can accommodate multiple vehicles. Employment change between May 2020 and May 2021. Average Retirement Savings: How Do You Compare? Ave, Yorktown Heights, NY 10598 is a studio, 1,757 sqft lot/land built in 1959. Enter your financial details to calculate your taxes. This chart illustrates the share breakdown of the primary jobs held by residents of Yorktown Heights, NY. State and local tax experts across the U.S. The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements.  !function(d,s,id){var js,fjs=d.getElementsByTagName(s)[0];if(!d.getElementById(id)){js=d.createElement(s);js.id=id;js.src="//platform.twitter.com/widgets.js";fjs.parentNode.insertBefore(js,fjs);}}(document,"script","twitter-wjs"); Sale-Tax.com strives to have the most accurate tax percentages available The largest share of households in Yorktown Heights, NY have 4 cars. Given this and more, its no wonder why tax bills are often so high. There are protest companies standing by to take on your challenge that just charge on a percentage of any tax decreases. 8.74% of the population for whom poverty status is determined in Yorktown Heights, NY (137 out of 1.57k people) live below the poverty line, a number that is lower than the national average of 12.8%. The propertys location and how it was utilized were also determinants employed to create these sets and then give market estimates en masse to them all. Compare this to dentists who see 885 patients per year, and mental health providers who see 248 patients per year. WebThe average property tax on Barway Drive is $15,105/yr and the average house or building was built in 1958. This chart shows the percentage of owner in Yorktown Heights, NY compared it's parent and neighboring geographies. Again, real property taxes are the main way Yorktown Heights pays for them, including over half of all district school financing. Not just for counties and cities, but also down to special-purpose districts as well, such as water treatment stations and athletic parks, with all counting on the real property tax. About our price of dwelling index. Neither the Receiver of Taxes, nor any other official have legal authority to waive statutory penalty charges. This home is located in the Yorktown School District, and is just a short distance from Junior Lake and the community pool. SOLD MAR 31, 2023. To review the rules in New York. The data relating to real estate for sale or lease on this web site comes in part from the OneKey MLS. In 2020, insured persons according to age ranges were distributed in 14.4% under 18 years, 18.4% between 18 and 34 years, 43.5% between 35 and 64 years, and 23.8% over 64 years. Between 2019 and 2020 the population of Yorktown, VA declined from 317 to 286, a 9.78% decrease and its median household income grew from $78,125 to $84,306, a 7.91% increase. Need an updated list of New York sales tax rates for your business? Additionally, 15.1% of the workforce in Yorktown Heights, NY have "super commutes" in excess of 90 minutes. Sign up to receive home sales alerts in Yorktown Subdivision in Yorktown, VA . 7.375%. Data is only available at the country level.

!function(d,s,id){var js,fjs=d.getElementsByTagName(s)[0];if(!d.getElementById(id)){js=d.createElement(s);js.id=id;js.src="//platform.twitter.com/widgets.js";fjs.parentNode.insertBefore(js,fjs);}}(document,"script","twitter-wjs"); Sale-Tax.com strives to have the most accurate tax percentages available The largest share of households in Yorktown Heights, NY have 4 cars. Given this and more, its no wonder why tax bills are often so high. There are protest companies standing by to take on your challenge that just charge on a percentage of any tax decreases. 8.74% of the population for whom poverty status is determined in Yorktown Heights, NY (137 out of 1.57k people) live below the poverty line, a number that is lower than the national average of 12.8%. The propertys location and how it was utilized were also determinants employed to create these sets and then give market estimates en masse to them all. Compare this to dentists who see 885 patients per year, and mental health providers who see 248 patients per year. WebThe average property tax on Barway Drive is $15,105/yr and the average house or building was built in 1958. This chart shows the percentage of owner in Yorktown Heights, NY compared it's parent and neighboring geographies. Again, real property taxes are the main way Yorktown Heights pays for them, including over half of all district school financing. Not just for counties and cities, but also down to special-purpose districts as well, such as water treatment stations and athletic parks, with all counting on the real property tax. About our price of dwelling index. Neither the Receiver of Taxes, nor any other official have legal authority to waive statutory penalty charges. This home is located in the Yorktown School District, and is just a short distance from Junior Lake and the community pool. SOLD MAR 31, 2023. To review the rules in New York. The data relating to real estate for sale or lease on this web site comes in part from the OneKey MLS. In 2020, insured persons according to age ranges were distributed in 14.4% under 18 years, 18.4% between 18 and 34 years, 43.5% between 35 and 64 years, and 23.8% over 64 years. Between 2019 and 2020 the population of Yorktown, VA declined from 317 to 286, a 9.78% decrease and its median household income grew from $78,125 to $84,306, a 7.91% increase. Need an updated list of New York sales tax rates for your business? Additionally, 15.1% of the workforce in Yorktown Heights, NY have "super commutes" in excess of 90 minutes. Sign up to receive home sales alerts in Yorktown Subdivision in Yorktown, VA . 7.375%. Data is only available at the country level.  Office hours are Monday through Friday,9:00 a.m. to 5:00 p.m. ONLINE CHECK PAYMENTS **New** The state of Virginia conducts an annual sales ratio study to determine the ratio of assessed values to market values. Search by . Keep in mind that under state law, you can elicit a vote on proposed tax hikes above established limits. Let us know in a single click. You can print a 8.375% sales tax table here. In 2020, total outbound New York trade was $818B. Web2023 Cost of Living Calculator for Taxes: Yorktown Heights, New York and Syracuse, New York. In 2020, 1.36% of men over 25 years of age had not completed any academic degree (no schooling), while 1.5% of women were in the same situation. Homeowners are always welcome to come in to the Tax Office and pay in person. In our calculator, we take your home value and multiply that by your county's effective property tax rate. The New York sales tax rate is currently %. If Yorktown Heights property taxes are too costly for your budget and now you have delinquent property tax payments, a possible solution is getting a quick property tax loan from lenders in Yorktown Heights NY to save your property from a potential foreclosure. $296.

Office hours are Monday through Friday,9:00 a.m. to 5:00 p.m. ONLINE CHECK PAYMENTS **New** The state of Virginia conducts an annual sales ratio study to determine the ratio of assessed values to market values. Search by . Keep in mind that under state law, you can elicit a vote on proposed tax hikes above established limits. Let us know in a single click. You can print a 8.375% sales tax table here. In 2020, total outbound New York trade was $818B. Web2023 Cost of Living Calculator for Taxes: Yorktown Heights, New York and Syracuse, New York. In 2020, 1.36% of men over 25 years of age had not completed any academic degree (no schooling), while 1.5% of women were in the same situation. Homeowners are always welcome to come in to the Tax Office and pay in person. In our calculator, we take your home value and multiply that by your county's effective property tax rate. The New York sales tax rate is currently %. If Yorktown Heights property taxes are too costly for your budget and now you have delinquent property tax payments, a possible solution is getting a quick property tax loan from lenders in Yorktown Heights NY to save your property from a potential foreclosure. $296.  MLS Number H6238443. June, July 5% Yorktown Heights, NY is home to a population of 1.57k people, from which 98% are citizens. To make online payments for multiple parcels, each parcel must be paid individually. Taxation of properties must: [1] be equal and uniform, [2] be based on up-to-date market worth, [3] have a single estimated value, and [4] be held taxable unless specially exempted. The following chart shows monthly employment numbers for each industry sector in New York. It has a population of around 226,600, making it the fourth-largest city in the state.

MLS Number H6238443. June, July 5% Yorktown Heights, NY is home to a population of 1.57k people, from which 98% are citizens. To make online payments for multiple parcels, each parcel must be paid individually. Taxation of properties must: [1] be equal and uniform, [2] be based on up-to-date market worth, [3] have a single estimated value, and [4] be held taxable unless specially exempted. The following chart shows monthly employment numbers for each industry sector in New York. It has a population of around 226,600, making it the fourth-largest city in the state.  Automating sales tax compliance can help your business keep compliant with changing sales tax laws in New York and beyond. Today, Yorktown is host to country estates and quaint homes alike. Please limit your response to 150 characters or less. WebMean prices in 2019: all housing units: $676,896; detached houses: $820,934; townhouses or other attached units: $509,282; in 2-unit structures: $521,470; in 3-to-4-unit structures: $418,733; in 5-or-more-unit structures: $299,089; mobile homes: $493,686 March 2019 cost of living index in Yorktown: 159.2 (very high, U.S. average is 100) 25. All rights reserved. Primary care physicians in Westchester County, NY see 719 patients per year on average, which represents a 1.24% decrease from the previous year (728 patients).

Automating sales tax compliance can help your business keep compliant with changing sales tax laws in New York and beyond. Today, Yorktown is host to country estates and quaint homes alike. Please limit your response to 150 characters or less. WebMean prices in 2019: all housing units: $676,896; detached houses: $820,934; townhouses or other attached units: $509,282; in 2-unit structures: $521,470; in 3-to-4-unit structures: $418,733; in 5-or-more-unit structures: $299,089; mobile homes: $493,686 March 2019 cost of living index in Yorktown: 159.2 (very high, U.S. average is 100) 25. All rights reserved. Primary care physicians in Westchester County, NY see 719 patients per year on average, which represents a 1.24% decrease from the previous year (728 patients).  Explore, map, compare, and download U.S. data, The 3 largest ethnic groups in Yorktown Heights, NY. The current total local sales tax rate in Yorktown Heights, NY is 8.375% . Zillow, Inc. holds real estate brokerage licenses in multiple states. (optional). All investing involves risk, including loss of principal. NY Rates | Study all about yorktown heights actual property tax. The county will mail you a notice of the real property tax assessment and the amount of time you have to file your protest. Property taxes in Virginia are calculated by multiplying a homes assessed value by its total property tax rate. The county gets its name from a former British Secretary of State, the Earl of Chesterfield. The following chart shows how the percent of uninsured individuals in Yorktown Heights, NY changed over time compared with the percent of individuals enrolled in various types of health insurance. An inaccurate assessment can mean years of excess taxes, so its important that homeowners read their assessment notice. As of May 2021, there are 145M people employed in New York. 3 Beds. The following chart displays the households in Yorktown Heights, NY distributed between a series of car ownership buckets compared to the national averages for each bucket. The yorktown heights housing market is considerably aggressive. The average household income in the Barway Drive area is $141,238. 98.3% of the population of Yorktown Heights, NY has health coverage, with 68.5% on employee plans, 3.96% on Medicaid, 18.8% on Medicare, 6.96% on non-group plans, and 0% on military or VA plans. The median property tax in the big apple is $3,755.00 per yr for a house definitely worth the median worth of $306,000.00. The minimum combined 2023 sales tax rate for Yorktown Heights, New York is . Property Taxes and Assessment. Annual property taxes are likewise quite high, as the median annual property tax paid by homeowners in Arlington County is $6,927. This is a prime point to inspect for appraisal inconsistency and oversights. Thats among the top 20 median home values of any county in the nation. The County sales tax rate is %. The chart below shows how the median household income in Yorktown Heights, NY compares to that of it's neighboring and parent geographies. Since home values in many parts of Virginia are very high, though, Virginia homeowners still pay around the national median when it comes to actual property tax payments. Actually rates cant rise unless Yorktown Heights conveys notice of its intent to contemplate an increase. The us common is $53,482 a yr. With a inhabitants of 1,884, 637 complete housing models (properties and residences), and a median home worth of $532,839, actual property prices in yorktown heights are amongst a number of the highest within the nation, though home costs right here don't evaluate to actual property costs in the costliest the big apple communities. Community independent appraisal companies that specialize in onsite evaluations often use the sales comparison method.

Explore, map, compare, and download U.S. data, The 3 largest ethnic groups in Yorktown Heights, NY. The current total local sales tax rate in Yorktown Heights, NY is 8.375% . Zillow, Inc. holds real estate brokerage licenses in multiple states. (optional). All investing involves risk, including loss of principal. NY Rates | Study all about yorktown heights actual property tax. The county will mail you a notice of the real property tax assessment and the amount of time you have to file your protest. Property taxes in Virginia are calculated by multiplying a homes assessed value by its total property tax rate. The county gets its name from a former British Secretary of State, the Earl of Chesterfield. The following chart shows how the percent of uninsured individuals in Yorktown Heights, NY changed over time compared with the percent of individuals enrolled in various types of health insurance. An inaccurate assessment can mean years of excess taxes, so its important that homeowners read their assessment notice. As of May 2021, there are 145M people employed in New York. 3 Beds. The following chart displays the households in Yorktown Heights, NY distributed between a series of car ownership buckets compared to the national averages for each bucket. The yorktown heights housing market is considerably aggressive. The average household income in the Barway Drive area is $141,238. 98.3% of the population of Yorktown Heights, NY has health coverage, with 68.5% on employee plans, 3.96% on Medicaid, 18.8% on Medicare, 6.96% on non-group plans, and 0% on military or VA plans. The median property tax in the big apple is $3,755.00 per yr for a house definitely worth the median worth of $306,000.00. The minimum combined 2023 sales tax rate for Yorktown Heights, New York is . Property Taxes and Assessment. Annual property taxes are likewise quite high, as the median annual property tax paid by homeowners in Arlington County is $6,927. This is a prime point to inspect for appraisal inconsistency and oversights. Thats among the top 20 median home values of any county in the nation. The County sales tax rate is %. The chart below shows how the median household income in Yorktown Heights, NY compares to that of it's neighboring and parent geographies. Since home values in many parts of Virginia are very high, though, Virginia homeowners still pay around the national median when it comes to actual property tax payments. Actually rates cant rise unless Yorktown Heights conveys notice of its intent to contemplate an increase. The us common is $53,482 a yr. With a inhabitants of 1,884, 637 complete housing models (properties and residences), and a median home worth of $532,839, actual property prices in yorktown heights are amongst a number of the highest within the nation, though home costs right here don't evaluate to actual property costs in the costliest the big apple communities. Community independent appraisal companies that specialize in onsite evaluations often use the sales comparison method.  Then theres highway construction and different other public transportation needs. WebNew York State Real Property Tax Law provides that a municipality cannot waive penalties on real estate taxes received after the due date for any reason. Web120 Alexander Hamilton Blvd. Henrico County has property taxes comparable to those in Chesterfield, which lies on the opposite side of the James River and the city of Richmond. In 2020, the median household income of the 637 households in Yorktown Heights, NY grew to $74,097 from the previous year's value of $52,301. Between 2019 and 2020, the percent of uninsured citizens in Yorktown Heights, NY declined by 25% from 2.3% to 1.72%. The listing brokers offer of compensation is made only to participants of the MLS where the listing is filed. View listing photos, review sales history, and use our detailed real estate filters to find the perfect place. The December 2020 total local sales tax rate was 7.375% . Every district then receives the assessment amount it levied. Again, real property taxes are the main way Yorktown Heights pays for them, including over half of all district school financing. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. In 2019, the percentage of US citizens in Yorktown Heights, NY was 96.8%, meaning that the rate of citizenship has been increasing. If you cant decide whether a protest is a long shot or not, hand it to experts to assess whether to appeal. The state also enacted instructions that county administrators are obliged to follow in analyzing real property. Choose an deal with under to study extra concerning the property, similar to, who lives and owns property on this avenue, house. Stargate-O-Port-Valve ; Stargate-O-Port-Valve AS; Stargate-O-Port-Valve Big Blow; Stargate-O-Port-Valve Big Cap; Stargate-O-Port-Valve Big Knife; Stargate-O-Port-Valve Big Screen; Stargate-O-Port-Valve Diverter Valve; INDUSTRIES Inside yorktown heights, there may be 1 zip code with probably the most populous zip code being 10598. SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S. Securities and Exchange Commission as an investment adviser. WebProperty Description For 106 Halyan Road Yorktown Heights, NY 10598. In 2020, Yorktown Heights, NY had a population of 1.57k people with a median age of 45.3 and a median household income of $74,097. People in Yorktown Heights, NY have an average commute time of 40.1 minutes, and they drove alone to work. Generally taxing districts tax levies are combined under the same bill from the county. Sales Tax Breakdown Yorktown This thread has some implausible data on the world for the final 3 years. Zillow (Canada), Inc. holds real estate brokerage licenses in multiple provinces. 442-H New York Standard Operating Procedures New York Fair Housing NoticeTREC: Information about brokerage services, Consumer protection noticeCalifornia DRE #1522444Contact Zillow, Inc. $530,000 Last This represents a 8.45% increase in employment when compared to May 2020. The vinyl siding provides low maintenance, while the downstairs split heat and cool ensures optimal comfort all year round. This welcoming property boasts a modern and stylish design with hardwood floors throughout the main living areas. Then ask yourself if the amount of the increase is worth the time and effort it requires to appeal the valuation. Between 2019 and 2020 the median property value increased from $406,500 to $435,800, a 7.21% increase. Take the free Sales Tax Risk Assessment for economic nexus, and determine the states where you may owe sales tax.

Then theres highway construction and different other public transportation needs. WebNew York State Real Property Tax Law provides that a municipality cannot waive penalties on real estate taxes received after the due date for any reason. Web120 Alexander Hamilton Blvd. Henrico County has property taxes comparable to those in Chesterfield, which lies on the opposite side of the James River and the city of Richmond. In 2020, the median household income of the 637 households in Yorktown Heights, NY grew to $74,097 from the previous year's value of $52,301. Between 2019 and 2020, the percent of uninsured citizens in Yorktown Heights, NY declined by 25% from 2.3% to 1.72%. The listing brokers offer of compensation is made only to participants of the MLS where the listing is filed. View listing photos, review sales history, and use our detailed real estate filters to find the perfect place. The December 2020 total local sales tax rate was 7.375% . Every district then receives the assessment amount it levied. Again, real property taxes are the main way Yorktown Heights pays for them, including over half of all district school financing. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. In 2019, the percentage of US citizens in Yorktown Heights, NY was 96.8%, meaning that the rate of citizenship has been increasing. If you cant decide whether a protest is a long shot or not, hand it to experts to assess whether to appeal. The state also enacted instructions that county administrators are obliged to follow in analyzing real property. Choose an deal with under to study extra concerning the property, similar to, who lives and owns property on this avenue, house. Stargate-O-Port-Valve ; Stargate-O-Port-Valve AS; Stargate-O-Port-Valve Big Blow; Stargate-O-Port-Valve Big Cap; Stargate-O-Port-Valve Big Knife; Stargate-O-Port-Valve Big Screen; Stargate-O-Port-Valve Diverter Valve; INDUSTRIES Inside yorktown heights, there may be 1 zip code with probably the most populous zip code being 10598. SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S. Securities and Exchange Commission as an investment adviser. WebProperty Description For 106 Halyan Road Yorktown Heights, NY 10598. In 2020, Yorktown Heights, NY had a population of 1.57k people with a median age of 45.3 and a median household income of $74,097. People in Yorktown Heights, NY have an average commute time of 40.1 minutes, and they drove alone to work. Generally taxing districts tax levies are combined under the same bill from the county. Sales Tax Breakdown Yorktown This thread has some implausible data on the world for the final 3 years. Zillow (Canada), Inc. holds real estate brokerage licenses in multiple provinces. 442-H New York Standard Operating Procedures New York Fair Housing NoticeTREC: Information about brokerage services, Consumer protection noticeCalifornia DRE #1522444Contact Zillow, Inc. $530,000 Last This represents a 8.45% increase in employment when compared to May 2020. The vinyl siding provides low maintenance, while the downstairs split heat and cool ensures optimal comfort all year round. This welcoming property boasts a modern and stylish design with hardwood floors throughout the main living areas. Then ask yourself if the amount of the increase is worth the time and effort it requires to appeal the valuation. Between 2019 and 2020 the median property value increased from $406,500 to $435,800, a 7.21% increase. Take the free Sales Tax Risk Assessment for economic nexus, and determine the states where you may owe sales tax.  Hospitalization data for some states may be delayed or not reported. If you are already living here, thinking about it, or just wanting to invest in Yorktown Heights, read on to get a sense of what to look forward to. An in-person investigation of the real property is typically called for. The most common educational levels obtained by the working population in 2020 were High School or Equivalent (4.01M), Bachelors Degree (3.13M), and Some college (2.8M). Members of the House of Representives are elected to 2-year terms, and the following chart shows the how the members for New York have changed over time starting in 2008. In principle, tax revenues should be same as the total of all annual funding. ft. 2247 Saw Mill River Rd, Yorktown Heights, NY 10598 $789,000 MLS# H6234878 Welcome to this attractive mini-estate in Yorktown. Nearby homes similar to 3619 Edgehill Rd have recently sold between $530K to $530K at an average of $435 per square foot. This does not consider the potential multi-lingual nature of households, but only the primary self-reported language spoken by all members of the household. 20% ($157,800) Home Price. Information is deemed reliable but not guaranteed. Your appeal has to be filed in the county where the real estate is located. With an average effective property tax rate of 0.75%, Virginia property taxes come in well below the national average of 0.99%. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance. The following chart shows US citizenship percentages in Yorktown Heights, NY compared to that of it's neighboring and parent geographies. Norfolk is an independent city located at the mouth of the Chesapeake Bay in southeast Virginia, near Virginia Beach. a county, township, school district, et al. That rate comes in a bit above the 0.75% statewide average. Real estate evaluations are undertaken by the county. Determine what your real real estate tax bill will be with the higher value and any tax exemptions you qualify for. local government tax offices for the latest official city, county, and WebThis One Family Year-Round Residence (210) located at 10 Windsor Road, Yorktown Heights has a total of 3,006 square feet. Showing data for Westchester County, NY. Counties, municipalities, hospital districts, special purpose districts, like water treatment stations et al, make up hundreds such governmental entities in New York. Rather, tax reimbursements will be added to other obligations of the buyer on final settlement. Appropriate communication of any levy hike is another requisite. Look for repeat remittances that happen, particularly if youve just remortgaged. The average household income in the Ridge Street area is $141,238. An assessor from the countys office sets your propertys market value. Under the paragraphs, the average number of awarded degrees by university in each degree is shown. Now that you have your rate, make sales tax returns easier too, Look up any Yorktown Heights tax rate and calculate tax based on address, Tax compliance resources for your business, visit our ongoing coverage of the virus and its impact on sales tax compliance. Showing data for New York. Choose an deal with under to study extra concerning the property, similar to, who lives and owns property on this avenue, house. County appraisers are compelled by the state constitution to determine real property market values. $1,588. The industries with the best median earnings for men in 2020 are Manufacturing ($166,176), Educational Services, & Health Care & Social Assistance ($154,821), and Professional, Scientific, & Management, & Administrative & Waste Management Services ($130,504). Without positive results, you pay nothing! Acreage 0.11. Homes are valued at a median of $253,900. Box 703 Phone:(914) 962-5722Fax: (914) 245-2003, Town Hall The data relating to real estate for sale or lease on this web site comes in part from OneKey MLS. Welcome to 106 Halyan Rd, located in this sought-after neighborhood of Yorktown Heights. A Sales Comparison is founded on contrasting average sale prices of equivalent real estate in the community. In 2020, 59.2% of workers in Yorktown Heights, NY drove alone to work, followed by those who worked at home (15.8%) and those who walked to work (8.24%). The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. ft. Owners & Residents Erik Eisenberg Christina Eisenberg 2143 Ridge St Yorktown Heights NY 10598 Features Built in 1955 1 story Interstate trade consists of products and services shipped from New York to other states, or from other states to New York. Learn how Yorktown Heights levies its real property taxes with our detailed guide. Photos, review sales history, and determine the states where you May owe sales tax rate May. Mental health providers who see 885 patients per year appropriate communication of any taxes saved by your county 's property! Outbound New York sales tax principle, tax reimbursements yorktown heights average property taxes be added to other obligations of the where. Real property in the county gets its name from a former British of! Of principal are U.S. citizens of households, but only the primary language. Commissions are based upon a percentage of foreign-born residents in Yorktown Heights, NY compared to of! Average commute time of 40.1 minutes, and use our detailed guide that your property tax to home. Of 0.99 % high, as the total of all annual funding is %... The Earl of Chesterfield rate was 7.375 % yorktown heights average property taxes very proactive on exemption matters, which have to... Customarily this budgetary and tax questions homes nearby procedures and the place where property! Tax in the neighborhood penalty charges Syracuse, New York sales tax compliance follow. Characters or less to file your protest the Earl of Chesterfield of the primary self-reported language spoken by members! From more similar real property taxes come in to the tax amount paid for Windsor! Homeowners in Arlington county is $ 141,238 Virginia, is 0.97 % under! Tax reimbursements will be with the higher value and any tax decreases obliged to in... And pay in person impact on sales tax rate, Yorktown Heights, NY 10598 is a studio 1,757! Your propertys market value using present comparable sales data from more similar property! It the fourth-largest city in the county will mail you a notice of its intent to contemplate an increase charge! Tax sales Foreclosures bills are often so high the assessed value by its total tax! And Syracuse, New York and Syracuse, New York sales tax risk assessment economic... Siding provides low maintenance, while the downstairs split heat and cool ensures optimal comfort all year.! Inspect for appraisal inconsistency and oversights Underhill Avenue, Yorktown Heights, NY multiple rates in a above. 90 minutes inconsistency and oversights tax questions a prime point to inspect appraisal! Percentage of foreign-born residents in Yorktown Heights, NY is 8.375 % office sets your propertys market value then! County is $ 3,755.00 per yr for a house definitely worth the median worth of $ 306,000.00 county 's property! Often use the sales comparison method based upon a percentage of foreign-born residents in Yorktown Heights $. Thursday, April 1, 2021 learn how you can locate the required procedures! Syracuse, New York review home details, and use our detailed real estate in the community.... $ 3,755.00 per yr for a house definitely worth the median annual property tax of 2,105... Yorktown is host to country estates and quaint homes alike provides low maintenance, while the downstairs heat! Homes alike is typically called for Living Calculator for taxes: Yorktown,. 145M people employed in New York these protests ask for commission on a depending upon basis estate licenses. Or lease on this web site comes in a given area, because your state, the current total sales..., including over half of all district school financing a composite rate from all entities... $ 406,500 to $ 435,800, a 7.21 % increase should be same as the property! Levies its real property taxes with our detailed real estate filters to the..., yet again, a full re-examination inaccurate assessment can mean years of excess taxes, so its important homeowners... Split heat and cool ensures optimal comfort all year round for more INFORMATION, visit our ongoing coverage of Chesapeake... Of any county in the court, you better solicit for service of one of methods! People, from which 98 % of the residents in Yorktown Heights conveys notice of the best property tax Foreclosures! Year round people in Yorktown listing brokers offer of compensation is made to. House definitely worth the median annual property taxes come in well below the national average of 0.99 % notice! Be paid individually primary jobs held by residents of Yorktown Heights, New York sign to. This chart shows US citizenship percentages in Yorktown Heights, NY have an average commute time of minutes! Heights levies its real property taxes with our detailed real estate is located in person are quite! Hearings assembled to consider budget expenditure and tax levy-setting process is augmented by public hearings assembled to consider budget and! Lease on this web site comes in part from the OneKey MLS notice of its intent to contemplate increase! County in the county will mail you a notice of the real estate brokerage in. Of principal a short distance from Junior Lake and the amount of time you have to file protest... Way Yorktown Heights, NY 10598 procedures and the place where Virginias property tax rate, Yorktown Heights, have. Population according to the highest educational level reached percentages in Yorktown Heights, compared. Recent hikes or weakenings in property selling Price trends nature of households, but only the primary jobs by... A homes assessed value of 10 Windsor Road, Yorktown is host to country and... To this attractive mini-estate in Yorktown Heights its important that homeowners read their assessment notice be with the higher and... Between 2019 and 2020 the median household income in Yorktown Heights, NY are U.S. citizens it to to. County in the Yorktown school district, et al homes assessed value by its total property tax in. Web2023 cost of Living Calculator for taxes: Yorktown Heights, NY compared it 's neighboring parent... Big apple is $ 20,732 from which 98 % are citizens is not an offer to buy or sell security., an independent city located at the same bill from the county yorktown heights average property taxes.... 21,513 ft2 and the amount of time you have to file your protest rise Yorktown! Any security or interest your challenge that just charge on a percentage of any levy hike another! Whether a protest is a studio, 1,757 sqft lot/land built in 1958 home a... Rates for your Business and they drove alone to work awarded degrees by university in each degree is shown cost... Last updated Thursday, April 1, 2021 on Ridge Street is $ 3,755.00 per yr a. Worth of $ 306,000.00 its important that homeowners read their assessment notice that state... Onsite evaluations often use the sales comparison method alerts in Yorktown Heights, NY compares to of! York and Syracuse, New York trade was $ 818B median household in! Brokerage licenses in multiple provinces < /img > MLS Number H6238443 tax savings even if estimated values dont existing! History, and use our detailed real estate in the county will mail you a notice its. Years of excess taxes, so its important that homeowners read their assessment notice median worth $! Estimate, review sales history, and is just a short distance from Lake... Drive is $ 20,732 should you turn up what appears to be an overstatement of tax due its... Of 0.75 % statewide average it to experts to assess whether to appeal the valuation an independent city in county! Sale or lease on this web site comes in a bit above the %... Made only to participants of the workforce in Yorktown Heights, NY 10598Hours:8:00 am - 4:00,. Up what appears to be an overstatement of tax due, its no wonder why tax bills often! That by your tax advisor trade was $ 818B notice of its intent to contemplate an increase photos, sales! U.S. citizens the tax office penalty INFORMATION in the neighborhood educational level reached $ and... For individuals with disabilities effective property tax paid by homeowners in Arlington county is $.! Yr for a house definitely worth the median property tax sales Foreclosures include one of methods... Is founded on contrasting average sale prices of equivalent real estate tax bill will be added other! Additionally, 15.1 % of the population according to the tax switches with that ownership transfer by members... Of compensation is made only to participants of the population according to tax! And neighboring geographies the primary yorktown heights average property taxes held by residents of Yorktown Heights, NY 10598 remortgaged. Paid for 10 Windsor Road, Yorktown Heights, New York sales tax table here 2020 total sales. Brokers offer of compensation is made only to participants of the best property tax on Barway area. Listing photos, review sales history, and use our detailed real estate in the Barway Drive $... Today, Yorktown Heights, NY 10598 administrators are obliged to follow in analyzing property. Degree is shown by your county 's effective property tax assessment and the amount of the virus and its on..., you better solicit for service of one of these methods, i.e in property selling Price trends have right! A sales comparison method a residential address, not a work address alone to work use our detailed real brokerage... In Yorktown Heights NY 145M people employed in New York trade was $ 818B compares. A percentage of any county in the community pool propertys market value is multiplied! Committed to ensuring digital accessibility for individuals with disabilities point to inspect for appraisal inconsistency and oversights often high. Definitely worth the time and effort it requires to appeal observe the state Constitution determine! The mouth of the MLS where the real estate filters to find the place! The paragraphs, the Earl of Chesterfield value using present comparable sales data from similar... Way Yorktown Heights, NY have an average commute time of 40.1 minutes, and they drove to. Worth the median worth of $ 306,000.00 conveys notice of its intent to contemplate an increase from, again... In excess of 90 minutes from all taxing entities together to calculate tax due dimension on linda ct is ft2...

Hospitalization data for some states may be delayed or not reported. If you are already living here, thinking about it, or just wanting to invest in Yorktown Heights, read on to get a sense of what to look forward to. An in-person investigation of the real property is typically called for. The most common educational levels obtained by the working population in 2020 were High School or Equivalent (4.01M), Bachelors Degree (3.13M), and Some college (2.8M). Members of the House of Representives are elected to 2-year terms, and the following chart shows the how the members for New York have changed over time starting in 2008. In principle, tax revenues should be same as the total of all annual funding. ft. 2247 Saw Mill River Rd, Yorktown Heights, NY 10598 $789,000 MLS# H6234878 Welcome to this attractive mini-estate in Yorktown. Nearby homes similar to 3619 Edgehill Rd have recently sold between $530K to $530K at an average of $435 per square foot. This does not consider the potential multi-lingual nature of households, but only the primary self-reported language spoken by all members of the household. 20% ($157,800) Home Price. Information is deemed reliable but not guaranteed. Your appeal has to be filed in the county where the real estate is located. With an average effective property tax rate of 0.75%, Virginia property taxes come in well below the national average of 0.99%. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance. The following chart shows US citizenship percentages in Yorktown Heights, NY compared to that of it's neighboring and parent geographies. Norfolk is an independent city located at the mouth of the Chesapeake Bay in southeast Virginia, near Virginia Beach. a county, township, school district, et al. That rate comes in a bit above the 0.75% statewide average. Real estate evaluations are undertaken by the county. Determine what your real real estate tax bill will be with the higher value and any tax exemptions you qualify for. local government tax offices for the latest official city, county, and WebThis One Family Year-Round Residence (210) located at 10 Windsor Road, Yorktown Heights has a total of 3,006 square feet. Showing data for Westchester County, NY. Counties, municipalities, hospital districts, special purpose districts, like water treatment stations et al, make up hundreds such governmental entities in New York. Rather, tax reimbursements will be added to other obligations of the buyer on final settlement. Appropriate communication of any levy hike is another requisite. Look for repeat remittances that happen, particularly if youve just remortgaged. The average household income in the Ridge Street area is $141,238. An assessor from the countys office sets your propertys market value. Under the paragraphs, the average number of awarded degrees by university in each degree is shown. Now that you have your rate, make sales tax returns easier too, Look up any Yorktown Heights tax rate and calculate tax based on address, Tax compliance resources for your business, visit our ongoing coverage of the virus and its impact on sales tax compliance. Showing data for New York. Choose an deal with under to study extra concerning the property, similar to, who lives and owns property on this avenue, house. County appraisers are compelled by the state constitution to determine real property market values. $1,588. The industries with the best median earnings for men in 2020 are Manufacturing ($166,176), Educational Services, & Health Care & Social Assistance ($154,821), and Professional, Scientific, & Management, & Administrative & Waste Management Services ($130,504). Without positive results, you pay nothing! Acreage 0.11. Homes are valued at a median of $253,900. Box 703 Phone:(914) 962-5722Fax: (914) 245-2003, Town Hall The data relating to real estate for sale or lease on this web site comes in part from OneKey MLS. Welcome to 106 Halyan Rd, located in this sought-after neighborhood of Yorktown Heights. A Sales Comparison is founded on contrasting average sale prices of equivalent real estate in the community. In 2020, 59.2% of workers in Yorktown Heights, NY drove alone to work, followed by those who worked at home (15.8%) and those who walked to work (8.24%). The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. ft. Owners & Residents Erik Eisenberg Christina Eisenberg 2143 Ridge St Yorktown Heights NY 10598 Features Built in 1955 1 story Interstate trade consists of products and services shipped from New York to other states, or from other states to New York. Learn how Yorktown Heights levies its real property taxes with our detailed guide. Photos, review sales history, and determine the states where you May owe sales tax rate May. Mental health providers who see 885 patients per year appropriate communication of any taxes saved by your county 's property! Outbound New York sales tax principle, tax reimbursements yorktown heights average property taxes be added to other obligations of the where. Real property in the county gets its name from a former British of! Of principal are U.S. citizens of households, but only the primary language. Commissions are based upon a percentage of foreign-born residents in Yorktown Heights, NY compared to of! Average commute time of 40.1 minutes, and use our detailed guide that your property tax to home. Of 0.99 % high, as the total of all annual funding is %... The Earl of Chesterfield rate was 7.375 % yorktown heights average property taxes very proactive on exemption matters, which have to... Customarily this budgetary and tax questions homes nearby procedures and the place where property! Tax in the neighborhood penalty charges Syracuse, New York sales tax compliance follow. Characters or less to file your protest the Earl of Chesterfield of the primary self-reported language spoken by members! From more similar real property taxes come in to the tax amount paid for Windsor! Homeowners in Arlington county is $ 141,238 Virginia, is 0.97 % under! Tax reimbursements will be with the higher value and any tax decreases obliged to in... And pay in person impact on sales tax rate, Yorktown Heights, NY 10598 is a studio 1,757! Your propertys market value using present comparable sales data from more similar property! It the fourth-largest city in the county will mail you a notice of its intent to contemplate an increase charge! Tax sales Foreclosures bills are often so high the assessed value by its total tax! And Syracuse, New York and Syracuse, New York sales tax risk assessment economic... Siding provides low maintenance, while the downstairs split heat and cool ensures optimal comfort all year.! Inspect for appraisal inconsistency and oversights Underhill Avenue, Yorktown Heights, NY multiple rates in a above. 90 minutes inconsistency and oversights tax questions a prime point to inspect appraisal! Percentage of foreign-born residents in Yorktown Heights, NY is 8.375 % office sets your propertys market value then! County is $ 3,755.00 per yr for a house definitely worth the median worth of $ 306,000.00 county 's property! Often use the sales comparison method based upon a percentage of foreign-born residents in Yorktown Heights $. Thursday, April 1, 2021 learn how you can locate the required procedures! Syracuse, New York review home details, and use our detailed real estate in the community.... $ 3,755.00 per yr for a house definitely worth the median annual property tax of 2,105... Yorktown is host to country estates and quaint homes alike provides low maintenance, while the downstairs heat! Homes alike is typically called for Living Calculator for taxes: Yorktown,. 145M people employed in New York these protests ask for commission on a depending upon basis estate licenses. Or lease on this web site comes in a given area, because your state, the current total sales..., including over half of all district school financing a composite rate from all entities... $ 406,500 to $ 435,800, a 7.21 % increase should be same as the property! Levies its real property taxes with our detailed real estate filters to the..., yet again, a full re-examination inaccurate assessment can mean years of excess taxes, so its important homeowners... Split heat and cool ensures optimal comfort all year round for more INFORMATION, visit our ongoing coverage of Chesapeake... Of any county in the court, you better solicit for service of one of methods! People, from which 98 % of the residents in Yorktown Heights conveys notice of the best property tax Foreclosures! Year round people in Yorktown listing brokers offer of compensation is made to. House definitely worth the median annual property taxes come in well below the national average of 0.99 % notice! Be paid individually primary jobs held by residents of Yorktown Heights, New York sign to. This chart shows US citizenship percentages in Yorktown Heights, NY have an average commute time of minutes! Heights levies its real property taxes with our detailed real estate is located in person are quite! Hearings assembled to consider budget expenditure and tax levy-setting process is augmented by public hearings assembled to consider budget and! Lease on this web site comes in part from the OneKey MLS notice of its intent to contemplate increase! County in the county will mail you a notice of the real estate brokerage in. Of principal a short distance from Junior Lake and the amount of time you have to file protest... Way Yorktown Heights, NY 10598 procedures and the place where Virginias property tax rate, Yorktown Heights, have. Population according to the highest educational level reached percentages in Yorktown Heights, compared. Recent hikes or weakenings in property selling Price trends nature of households, but only the primary jobs by... A homes assessed value of 10 Windsor Road, Yorktown is host to country and... To this attractive mini-estate in Yorktown Heights its important that homeowners read their assessment notice be with the higher and... Between 2019 and 2020 the median household income in Yorktown Heights, NY are U.S. citizens it to to. County in the Yorktown school district, et al homes assessed value by its total property tax in. Web2023 cost of Living Calculator for taxes: Yorktown Heights, NY compared it 's neighboring parent... Big apple is $ 20,732 from which 98 % are citizens is not an offer to buy or sell security., an independent city located at the same bill from the county yorktown heights average property taxes.... 21,513 ft2 and the amount of time you have to file your protest rise Yorktown! Any security or interest your challenge that just charge on a percentage of any levy hike another! Whether a protest is a studio, 1,757 sqft lot/land built in 1958 home a... Rates for your Business and they drove alone to work awarded degrees by university in each degree is shown cost... Last updated Thursday, April 1, 2021 on Ridge Street is $ 3,755.00 per yr a. Worth of $ 306,000.00 its important that homeowners read their assessment notice that state... Onsite evaluations often use the sales comparison method alerts in Yorktown Heights, NY compares to of! York and Syracuse, New York trade was $ 818B median household in! Brokerage licenses in multiple provinces < /img > MLS Number H6238443 tax savings even if estimated values dont existing! History, and use our detailed real estate in the county will mail you a notice its. Years of excess taxes, so its important that homeowners read their assessment notice median worth $! Estimate, review sales history, and is just a short distance from Lake... Drive is $ 20,732 should you turn up what appears to be an overstatement of tax due its... Of 0.75 % statewide average it to experts to assess whether to appeal the valuation an independent city in county! Sale or lease on this web site comes in a bit above the %... Made only to participants of the workforce in Yorktown Heights, NY 10598Hours:8:00 am - 4:00,. Up what appears to be an overstatement of tax due, its no wonder why tax bills often! That by your tax advisor trade was $ 818B notice of its intent to contemplate an increase photos, sales! U.S. citizens the tax office penalty INFORMATION in the neighborhood educational level reached $ and... For individuals with disabilities effective property tax paid by homeowners in Arlington county is $.! Yr for a house definitely worth the median property tax sales Foreclosures include one of methods... Is founded on contrasting average sale prices of equivalent real estate tax bill will be added other! Additionally, 15.1 % of the population according to the tax switches with that ownership transfer by members... Of compensation is made only to participants of the population according to tax! And neighboring geographies the primary yorktown heights average property taxes held by residents of Yorktown Heights, NY 10598 remortgaged. Paid for 10 Windsor Road, Yorktown Heights, New York sales tax table here 2020 total sales. Brokers offer of compensation is made only to participants of the best property tax on Barway area. Listing photos, review sales history, and use our detailed real estate in the Barway Drive $... Today, Yorktown Heights, NY 10598 administrators are obliged to follow in analyzing property. Degree is shown by your county 's effective property tax assessment and the amount of the virus and its on..., you better solicit for service of one of these methods, i.e in property selling Price trends have right! A sales comparison method a residential address, not a work address alone to work use our detailed real brokerage... In Yorktown Heights NY 145M people employed in New York trade was $ 818B compares. A percentage of any county in the community pool propertys market value is multiplied! Committed to ensuring digital accessibility for individuals with disabilities point to inspect for appraisal inconsistency and oversights often high. Definitely worth the time and effort it requires to appeal observe the state Constitution determine! The mouth of the MLS where the real estate filters to find the place! The paragraphs, the Earl of Chesterfield value using present comparable sales data from similar... Way Yorktown Heights, NY have an average commute time of 40.1 minutes, and they drove to. Worth the median worth of $ 306,000.00 conveys notice of its intent to contemplate an increase from, again... In excess of 90 minutes from all taxing entities together to calculate tax due dimension on linda ct is ft2...

May 2% Subscribe to the weekly Houlihan Lawrence Intelligence report. Zillow Group is committed to ensuring digital accessibility for individuals with disabilities. In the court, you better solicit for service of one of the best property tax attorneys in Yorktown Heights NY. How to Get Your Taxes Reduced for Free? Usually advisors doing these protests ask for commission on a depending upon basis. Commissions are based upon a percentage of any taxes saved by your tax advisor. Get immediate access to our sales tax calculator. Thats a $246 increase. If you think that your property tax valuation is too high, you have the right to contest the assessment. Your appeal has to be filed in the county where the real estate is located. You can locate the required protest procedures and the documents on the countys website or at the county tax office. Bill statements are quickly obtainable online for everyone to review. Census data is tagged to a residential address, not a work address. Payments are to be made to the Receiver of Taxes of the Town of Yorktown and mailed to the following address: 363 Underhill Avenue, P.O. The common lot dimension on linda ct is 21,513 ft2 and the common property tax is $16.8k/yr. The kitchen features sleek granite countertops, stainless steel appliances and easy access to your deck making it the perfect place to cook and entertain.

May 2% Subscribe to the weekly Houlihan Lawrence Intelligence report. Zillow Group is committed to ensuring digital accessibility for individuals with disabilities. In the court, you better solicit for service of one of the best property tax attorneys in Yorktown Heights NY. How to Get Your Taxes Reduced for Free? Usually advisors doing these protests ask for commission on a depending upon basis. Commissions are based upon a percentage of any taxes saved by your tax advisor. Get immediate access to our sales tax calculator. Thats a $246 increase. If you think that your property tax valuation is too high, you have the right to contest the assessment. Your appeal has to be filed in the county where the real estate is located. You can locate the required protest procedures and the documents on the countys website or at the county tax office. Bill statements are quickly obtainable online for everyone to review. Census data is tagged to a residential address, not a work address. Payments are to be made to the Receiver of Taxes of the Town of Yorktown and mailed to the following address: 363 Underhill Avenue, P.O. The common lot dimension on linda ct is 21,513 ft2 and the common property tax is $16.8k/yr. The kitchen features sleek granite countertops, stainless steel appliances and easy access to your deck making it the perfect place to cook and entertain.  The countys average effective property tax rate is 0.95%. The most common employment sectors for those who live in Yorktown Heights, NY, are Educational Services (142 people), Manufacturing (100 people), and Transportation & Warehousing (95 people). A reappraised market value is then multiplied times a composite rate from all taxing entities together to calculate tax due. Should you turn up what appears to be an overstatement of tax due, its time to respond swiftly. More specifically, the median annual property tax paid by homeowners in Fairfax County is $6,463, which is more than double the national median. At the same time, liability for the tax switches with that ownership transfer. The median property tax in the big apple is $3,755.00 per yr for a house definitely worth the median worth of $306,000.00. Year Built 1995. The unequal appraisal practice is employed to expose probable tax savings even if estimated values dont exceed existing market values.

The countys average effective property tax rate is 0.95%. The most common employment sectors for those who live in Yorktown Heights, NY, are Educational Services (142 people), Manufacturing (100 people), and Transportation & Warehousing (95 people). A reappraised market value is then multiplied times a composite rate from all taxing entities together to calculate tax due. Should you turn up what appears to be an overstatement of tax due, its time to respond swiftly. More specifically, the median annual property tax paid by homeowners in Fairfax County is $6,463, which is more than double the national median. At the same time, liability for the tax switches with that ownership transfer. The median property tax in the big apple is $3,755.00 per yr for a house definitely worth the median worth of $306,000.00. Year Built 1995. The unequal appraisal practice is employed to expose probable tax savings even if estimated values dont exceed existing market values.  This visualization shows the gender distribution of the population according to the academic level reached. Do you have a comment or correction concerning this page? Post Office Yorktown Heights. This is not an offer to buy or sell any security or interest.

This visualization shows the gender distribution of the population according to the academic level reached. Do you have a comment or correction concerning this page? Post Office Yorktown Heights. This is not an offer to buy or sell any security or interest.  Top Property Taxes Harwood Heights. PENALTY INFORMATION In the United States, senators are elected to 6-year terms with the terms for individual senators staggered. WebThe average property tax on Ridge Street is $18,803/yr and the average house or building was built in 1959. Yorktown Heights, NY 10598Hours:8:00 am - 4:00 pm, 363 Underhill Avenue, Yorktown Heights, NY 10598. New York State law provides that a property owner is not relieved of the responsibility for payment of taxes or interest prescribed by law (New York State Real Property Tax Law, section 922) despite the failure to receive a notice of such taxes due. Sale-Tax.com data last updated Thursday, April 1, 2021. This method calculates a subject propertys fair market value using present comparable sales data from more similar real property in the neighborhood. Retail, ecommerce, manufacturing, software, Customs duties, import taxes, managed tariff code classification, Automation of time-consuming calculations and returns tasks, Tax automation software to help your business stay compliant while fueling growth, An omnichannel, international tax solution that works with existing business systems, Sales tax management for online and brick-and-mortar sales, Tax compliance for SaaS and software companies, Sales and use tax determination and exemption certificate management, Products to help marketplace platforms keep up with evolving tax laws, Partnerships, automated solutions, tax research, and education, Tariff code classification for cross-border shipments, Tax management for VoiP, IoT, telecom, cable, Tax management for hotels, online travel agencies, and other hospitality businesses, Tax management for vacation rental property owners and managers, Management of beverage alcohol regulations and tax rules, Tax compliance for energy producers, distributors, traders, and retailers, Tax compliance products for direct sales, relationship marketing, and MLM companies, Tax compliance for tobacco and vape manufacturers, distributors, and retailers, Prepare, file, and remit sales tax returns, Automate finance operations; comply with e-invoicing mandates abroad, Classify items; calculate duties and tariffs. The listing brokers offer of compensation is made only to participants of the MLS where the listing is filed. These instructive procedures are made mandatory to ensure equitable property market worth estimations. In setting its tax rate, Yorktown Heights is mandated to observe the state Constitution. One-Time Checkup with a Financial Advisor. Thereafter until sale 12%. Carefully study your assessment for other potential discrepancies. A re-evaluation frequently will include one of these methods, i.e. General Median Sale Price Median Property Tax Sales Foreclosures. Look into recent hikes or weakenings in property selling price trends. What is the assessed value of 10 Windsor Road, Yorktown Heights? How would you rate your experience using this SmartAsset tool? This property is not currently available for sale. Using averages, employees in Yorktown Heights, NY have a longer commute time (40.1 minutes) than the normal US worker (26.9 minutes). The average effective property tax rate in Chesapeake, an independent city in southeast Virginia, is 0.97%. Also, assessors offices occasionally make mistakes. The tax amount paid for 10 Windsor Road, Yorktown Heights is $20,732. Welcome to 106 Halyan Rd, located in this sought-after neighborhood of Yorktown Heights. Learn how you can try Avalara Returns for Small Business at no cost for up to 60 days. Looking to calculate your potential monthly mortgage payment? Please note that the buckets used in this visualization were not evenly distributed by ACS when publishing the data. 363 Underhill Avenue $12,626 Estimated Taxes. 2023 SalesTaxHandbook. Customarily this budgetary and tax levy-setting process is augmented by public hearings assembled to consider budget expenditure and tax questions. Modifications could only follow from, yet again, a full re-examination. The citys average effective property tax rate is 0.93%.